Recent Posts

TFSA Tax-Free Savings Account

What is TFSA

The Tax-Free Savings Account (TFSA) program began in 2009. Any amount contributed as well as any income earned in the account (for example, investment income and capital gains) is generally tax-free, even when it is withdrawn.

Features of TFSA

1. You do not have to pay tax for the investment income or value-added portion earned in TFSA. You don’t have to pay taxes for withdrawals.

2. The maximum amount that you can contribute to your TFSA is limited by your TFSA contribution room. TFSA contribution room accumulates every year.

3. The amount you withdraw can be re-deposited into the tax-free savings account in the coming year (or in the next few years), and it will not affect your contribution room.

Contribution room of TFSA

You will accumulate TFSA contribution room for each year even if you do not file an Income Tax and Benefit Return or open a TFSA.

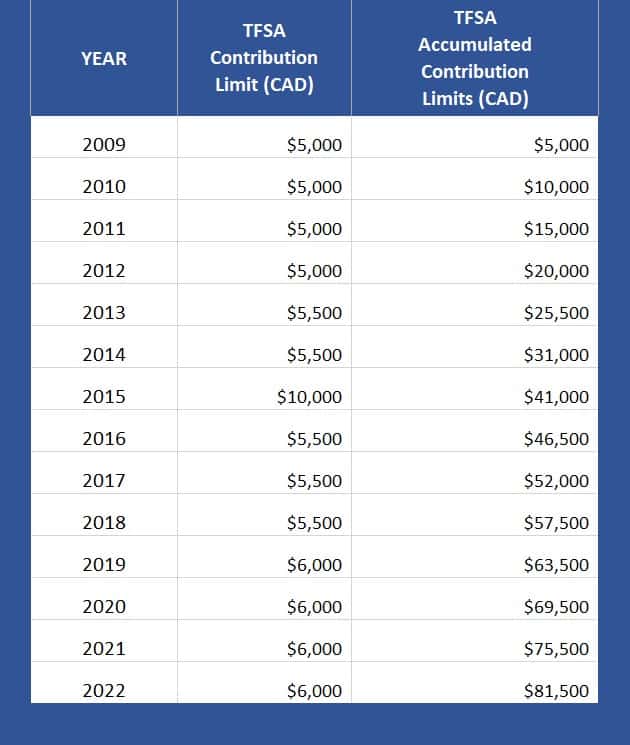

The annual TFSA dollar limit for the years 2009 to 2012 was $5,000.

The annual TFSA dollar limit for the years 2013 and 2014 was $5,500.

The annual TFSA dollar limit for the year 2015 was $10,000.

The annual TFSA dollar limit for the years 2016 to 2018 was $5,500.

The annual TFSA dollar limit for the years 2019 to 2022 is $6,000.

Who can buy TFSA

Any individual who is 18 years of age or older and who has a valid social insurance number (SIN) is eligible to open a TFSA.

What you can buy from TFSA

You can hold a variety of investments in TFSA, including most financial products from market. For details, please consult the customer service of AI Financial.

Will TFSA affect the government guaranteed income subsidy?

No. TFSA’s investment income and withdrawals are deductible for income tax purposes, which means they will not affect your eligibility for federal income test government benefits and credits, such as Canadian child tax benefits, work income tax benefits, guaranteed income grants, and pensions Gold (OAS) or Goods and Services Tax (GST) credits.

How to open a TFSA Account

Please contact AI Financial advisor to help you open a TFSA account.

RELATED READING

CRA 内部大清理:一年 370 起员工违规,多人因偷领 CERB 被解雇 | AiF insight

加拿大税务局披露最新年度报告,过去一年共记录 370 起员工违规事件,25 人被解雇,另有大量员工因违规领取 CERB 而被炒。

Read MoreCRA 改变立场:互惠基金 trailing commissions 将纳入 GST/HST 征税 | AiF Advisor

加拿大税务局重新界定 mutual fund trailing commissions 的税务属性,自 7 月 1 日起普遍纳入...

Read MoreSun Life 下调首年佣金并提高续期佣金,终身寿险补偿结构走向水平化 | AiF Advisor

Sun Life 调整 Par Accumulator II 分红型终身寿险的佣金结构,降低首年佣金、提高长期续期补偿,与监管对激励管理的方向高度一致。

Read More