Recent Posts

- 加拿大就业市场停滞:每1个职位空缺对应3名失业者 | AiF insight 02/27/2026

- 加拿大消费者破产创16年新高:食品价格上涨加剧家庭财务压力 | AiF insight 02/26/2026

- 标普500周四收低,英伟达财报后回落压制市场 | AiF 财经日报 02/26/2026

- 博励治谈对美关系:加强对华合作不能取代美国,加拿大不应永久决裂 | AiF insight 02/26/2026

TFSA Tax-Free Savings Account

What is TFSA

The Tax-Free Savings Account (TFSA) program began in 2009. Any amount contributed as well as any income earned in the account (for example, investment income and capital gains) is generally tax-free, even when it is withdrawn.

Features of TFSA

1. You do not have to pay tax for the investment income or value-added portion earned in TFSA. You don’t have to pay taxes for withdrawals.

2. The maximum amount that you can contribute to your TFSA is limited by your TFSA contribution room. TFSA contribution room accumulates every year.

3. The amount you withdraw can be re-deposited into the tax-free savings account in the coming year (or in the next few years), and it will not affect your contribution room.

Contribution room of TFSA

You will accumulate TFSA contribution room for each year even if you do not file an Income Tax and Benefit Return or open a TFSA.

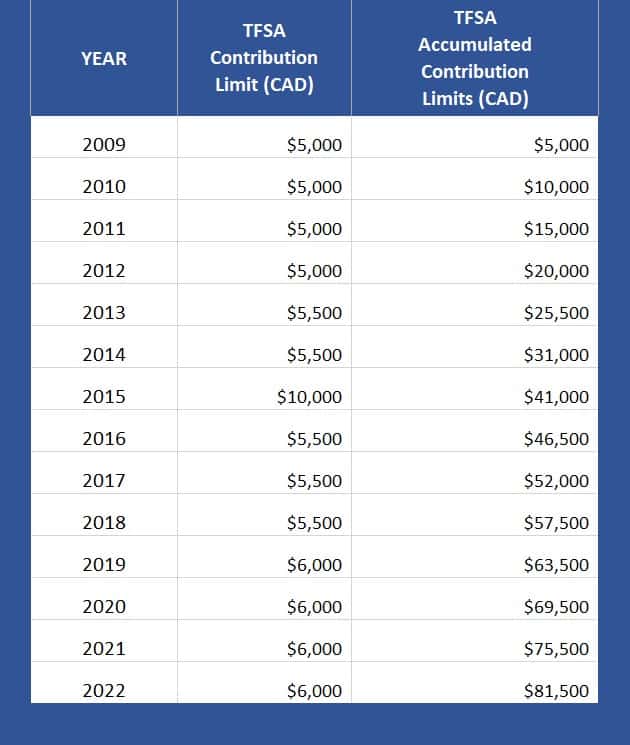

The annual TFSA dollar limit for the years 2009 to 2012 was $5,000.

The annual TFSA dollar limit for the years 2013 and 2014 was $5,500.

The annual TFSA dollar limit for the year 2015 was $10,000.

The annual TFSA dollar limit for the years 2016 to 2018 was $5,500.

The annual TFSA dollar limit for the years 2019 to 2022 is $6,000.

Who can buy TFSA

Any individual who is 18 years of age or older and who has a valid social insurance number (SIN) is eligible to open a TFSA.

What you can buy from TFSA

You can hold a variety of investments in TFSA, including most financial products from market. For details, please consult the customer service of AI Financial.

Will TFSA affect the government guaranteed income subsidy?

No. TFSA’s investment income and withdrawals are deductible for income tax purposes, which means they will not affect your eligibility for federal income test government benefits and credits, such as Canadian child tax benefits, work income tax benefits, guaranteed income grants, and pensions Gold (OAS) or Goods and Services Tax (GST) credits.

How to open a TFSA Account

Please contact AI Financial advisor to help you open a TFSA account.

RELATED READING

加拿大就业市场停滞:每1个职位空缺对应3名失业者 | AiF insight

加拿大就业市场放缓,12月失业率升至6.8%,全国每1个职位空缺对应3名失业者。职位空缺下降与技能错配问题并存,劳动力市场承压。

Read More加拿大消费者破产创16年新高:食品价格上涨加剧家庭财务压力 | AiF insight

加拿大消费者破产数量在2025年创16年新高,平均无担保债务接近6.7万加元,食品价格上涨与生活成本增加成为家庭财务压力的重要因素。

Read More